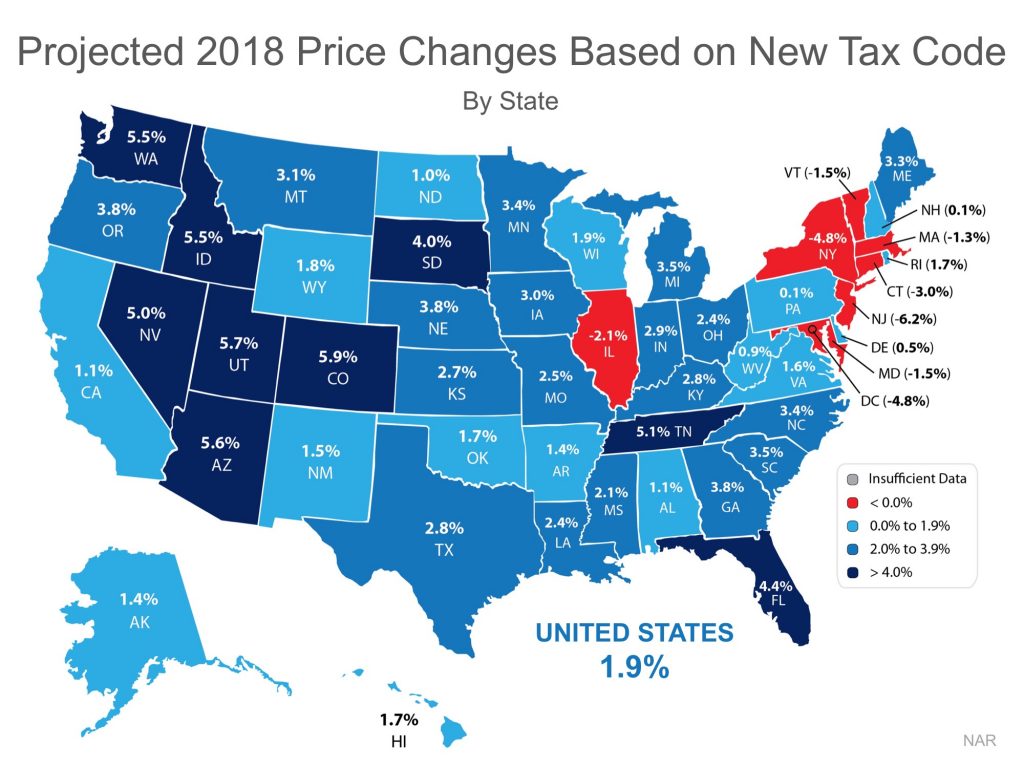

Across the nation, property taxes impose one of the most substantial state and local tax burdens most businesses face. Many states and localities also levy taxes not only on the land and buildings a business owns but also on tangible property, such as machinery, equipment, and office furniture, as well as intangible property like patents and trademarks. First, businesses own a significant amount of real property, and tax rates on commercial property are often higher than the rates on comparable residential property. Property taxes matter to businesses for several reasons. The property tax component accounts for 14.4 percent of each state’s overall Index score. The Index’s property tax A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.Ĭomponent evaluates state and local taxes on real and personal property, net worth, and asset transfers. and help fund schools, roads, police, and other services.Ĭomponent of our 2022 State Business Tax Climate Index. Property taxes are the single largest source of state and local revenue in the U.S.

Today’s map shows states’ rankings on the property tax A property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment.

0 kommentar(er)

0 kommentar(er)